How to Interpret Market News for Your Investment Portfolio

4 min read | 27 Jan 2025

In the world of investing, market news plays a critical role in shaping decisions. Understanding how to interpret this information effectively can help you make informed choices about your investment portfolio. Whether it's news about interest rates, geopolitical events, or corporate earnings, knowing how to process this information is key to navigating the financial landscape.

Understanding the Impact of Market News

Market news often includes economic indicators, corporate announcements, government policies, and global events. Each of these elements can influence stock prices, bond yields, and overall market sentiment. The challenge lies in understanding how each piece of news will affect the broader market and your investments specifically. For example, news about rising interest rates might indicate tighter financial conditions, which could negatively impact stocks, particularly those of companies with high debt levels.

Similarly, news about economic growth can signal a robust market, prompting investors to be more optimistic about their portfolios. Understanding the context and the long-term implications of the news helps investors react strategically rather than emotionally.

Key Economic Indicators to Watch

There are several economic indicators that investors should watch to gauge the health of the economy. These include the Consumer Price Index (CPI), unemployment rates, GDP growth, and interest rates. Each indicator can provide insight into the future direction of the economy and, by extension, the market.

For instance, high inflation reported in the CPI can lead to higher interest rates, which might cause stock prices to fall. On the other hand, a rise in GDP growth typically signals a strong economy, which is favorable for equities. Monitoring these indicators regularly can give investors an edge in making timely decisions.

Corporate News and Earnings Reports

Corporate earnings reports are another crucial element of market news. Earnings season, which typically occurs quarterly, can significantly influence the stock prices of individual companies. Positive earnings results often lead to stock price increases, while disappointing reports can have the opposite effect.

Investors should pay close attention to earnings per share (EPS), revenue growth, and guidance provided by companies. This information gives a deeper understanding of a company's financial health and its ability to grow in the future.

Geopolitical Events and Their Market Impact

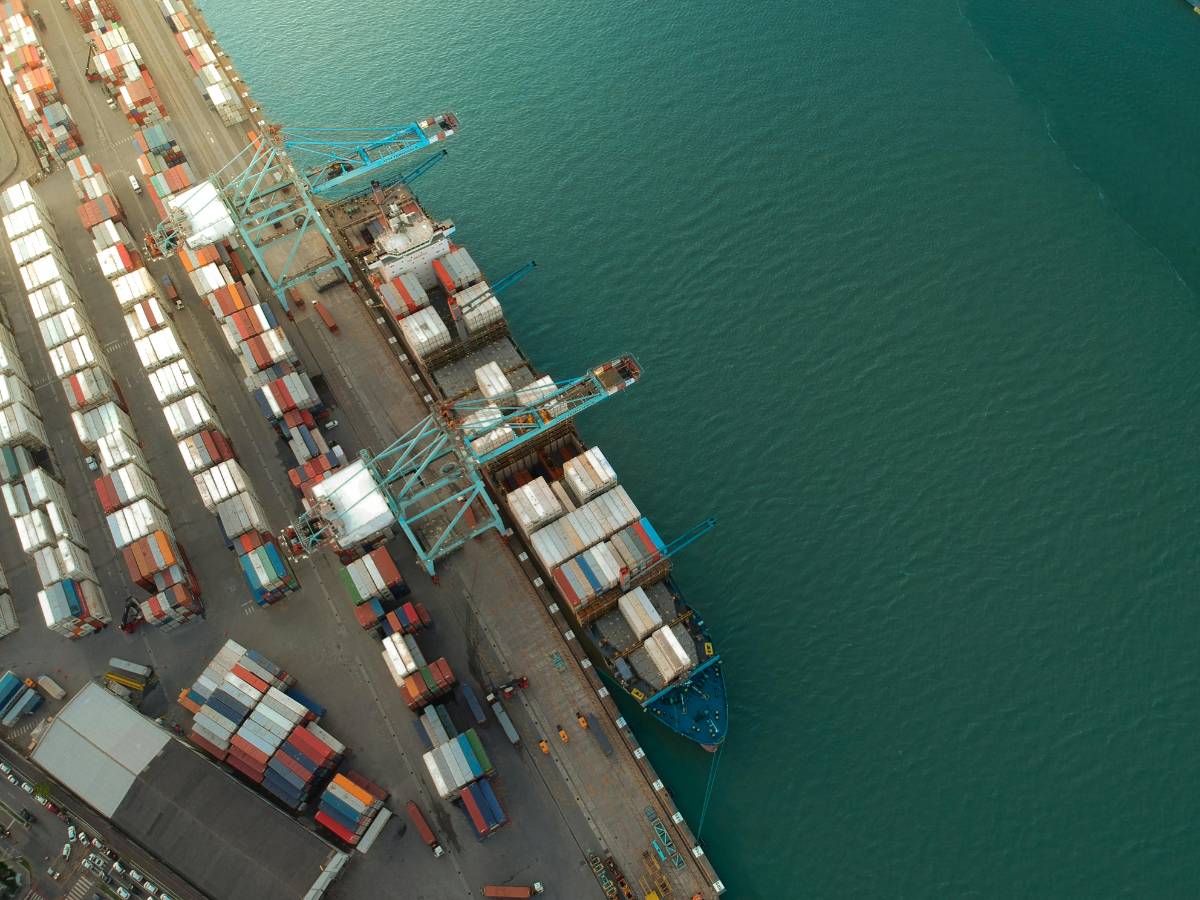

Geopolitical events, such as elections, wars, and trade negotiations, can have a profound impact on the financial markets. These events create uncertainty, which often leads to market volatility. For example, trade tensions between two major economies can result in market declines, especially in industries reliant on global trade.

Investors should remain aware of these events and evaluate their potential impact on their investment portfolios. While geopolitical risks cannot always be avoided, diversifying investments across sectors and regions can help mitigate their effects.

Interpreting Market Sentiment

Market sentiment refers to the overall attitude of investors toward a particular security or market. News can significantly influence sentiment, either making investors optimistic (bullish) or pessimistic (bearish). However, sentiment can sometimes be irrational or driven by short-term factors.

Investors need to separate market sentiment from long-term fundamentals. For example, if a stock falls due to negative news that doesn’t impact its core business, it may present an opportunity to buy at a lower price. Understanding sentiment is crucial in determining whether the market’s reaction is justified or overblown.

Utilizing Market News for Portfolio Adjustments

Once you understand how to interpret market news, the next step is using it to make informed decisions about your portfolio. Market news can guide you to make adjustments, such as reallocating investments or buying and selling specific assets.

If news suggests that interest rates will rise, you might consider shifting investments away from interest-sensitive sectors like real estate and utilities. On the other hand, news of technological advancements may prompt you to increase exposure to the tech sector. The key is to align your portfolio with the information and trends that emerge from market news.

Risk Management in Response to News

While market news can provide valuable insights, it also comes with the risk of overreacting to short-term events. Panic selling or buying based on headlines can lead to poor investment decisions. That’s why it’s important to have a well-thought-out risk management strategy in place.

Risk management strategies, such as setting stop-loss orders, diversifying your holdings, and maintaining a long-term perspective, can help you avoid making rash decisions in reaction to market news. Staying calm and sticking to your investment plan will keep you focused on your long-term goals.

Conclusion

In 2024, staying informed about market news is essential for making smart investment decisions. However, it’s not enough to just consume the news—investors must be able to interpret it in the context of their overall investment strategy. By understanding key economic indicators, following corporate earnings reports, staying aware of geopolitical risks, and managing sentiment, you can make more informed decisions about your portfolio. Ultimately, by interpreting market news wisely, you can position yourself for success in both rising and falling markets.

Share on

Similar articles

Localization Strategies for Global E-commerce Websites

2 min read | 07 Jan 2025

How to Handle International Shipping and Duties

5 min read | 06 Jan 2025

Cultural Considerations for Global E-commerce

2 min read | 05 Jan 2025