Analyzing the Latest Market Shifts and Their Impact

4 min read | 22 Jan 2025

In the fast-paced world of finance, market shifts are a common occurrence. These fluctuations can be driven by a variety of factors, including economic data, corporate earnings, geopolitical events, and investor sentiment. Understanding the underlying causes of these market shifts is crucial for making informed investment decisions. Today, we take a closer look at the latest market changes and their potential impact on various sectors and the broader economy.

Economic Data Driving Market Movements

Economic data plays a significant role in influencing market behavior. Key reports such as GDP growth, inflation rates, and unemployment figures can create shifts in investor sentiment and stock prices. Recent data showing stronger-than-expected economic growth has boosted investor confidence, leading to positive market movements. However, inflation concerns remain, keeping some investors cautious about the future economic outlook.

The latest economic indicators suggest that the economy is growing at a steady pace, but inflationary pressures continue to persist. This has led to mixed reactions in the stock market, with certain sectors like technology and consumer goods benefiting from growth while others, such as utilities, are feeling the impact of rising costs. As economic data continues to roll in, market participants are keeping a close watch on how it might influence monetary policy decisions by central banks.

Corporate Earnings and Sector Performance

Corporate earnings reports are always a significant catalyst for market movement. This earnings season has been characterized by some positive surprises, particularly from technology companies. Strong results from major tech firms have helped lift the Nasdaq, reflecting investor optimism in the tech sector. However, other industries have faced challenges, particularly those dependent on raw materials, as global supply chain disruptions and inflation have impacted their bottom lines.

The ongoing shift in consumer behavior, with more focus on digital services, has benefited companies in e-commerce and tech. Conversely, sectors like energy and materials have seen a decline due to rising input costs and geopolitical risks that are affecting the price of commodities. As corporate earnings continue to roll in, markets are reacting based on whether companies meet or exceed expectations, especially in high-growth industries.

Geopolitical Tensions and Their Market Impact

Geopolitical events can have a profound effect on market sentiment, often leading to volatility. Recent tensions in global trade, particularly between major economies, have caused some uncertainty in the markets. Investors are closely monitoring developments related to trade agreements, tariffs, and diplomatic relations, as these factors can affect supply chains and corporate profits.

Today’s market shifts have been partly influenced by escalating geopolitical concerns, which have led to sell-offs in sectors sensitive to international trade, such as manufacturing and agriculture. Conversely, safe-haven assets like gold and government bonds have seen a rise as investors seek stability amidst the uncertainty. These geopolitical shifts highlight the interconnected nature of the global economy and their potential ripple effects on financial markets.

Central Bank Actions and Interest Rate Policies

Central bank policies, especially regarding interest rates, are another key driver of market shifts. The Federal Reserve and other central banks play an essential role in controlling inflation and stimulating or slowing down economic activity. Recent remarks from central bank officials about the potential for interest rate hikes have created volatility in the stock market, particularly in sectors sensitive to borrowing costs.

Higher interest rates generally make borrowing more expensive, which can put pressure on companies that rely heavily on debt. Growth stocks, which tend to have higher valuations, can also be hit harder when rates rise. On the other hand, rising rates often benefit financial institutions like banks, which profit from higher interest rates on loans. As investors digest central bank statements and economic data, the market is adjusting accordingly, with some sectors seeing gains while others experience declines.

Investor Sentiment and Market Psychology

Investor sentiment plays a crucial role in market dynamics. When investors are optimistic, they are more likely to buy stocks, driving prices higher. However, periods of uncertainty can lead to a sell-off as investors try to minimize risk. Currently, investor sentiment is mixed, with some sectors, such as technology, showing strength, while others remain under pressure due to economic uncertainties and geopolitical concerns.

Market psychology is heavily influenced by the news cycle and media coverage. Positive earnings reports and economic data can shift sentiment towards optimism, while negative headlines can cause sudden market corrections. Understanding market psychology can be just as important as understanding fundamental data, as it helps investors predict how the market might react to upcoming events.

Market Trends and Technical Indicators

Technical analysis is an essential tool for understanding market trends and making investment decisions. By studying charts, patterns, and technical indicators like moving averages, investors can identify trends and predict potential price movements. Right now, the market is seeing some key technical levels being tested, with major indices approaching resistance points that could lead to further shifts in market direction.

Traders are closely watching these technical indicators to gauge whether the recent market shifts are part of a larger trend or temporary volatility. For example, the performance of the S&P 500 and other major indices could provide insight into whether the current market movement is sustainable. Technical indicators, combined with fundamental analysis, help investors make more informed decisions during periods of market fluctuation.

With these factors at play, the latest market shifts present both opportunities and challenges for investors. Staying informed about economic data, corporate earnings, geopolitical events, and central bank policies is essential for navigating today’s complex market environment. By carefully analyzing these market drivers, investors can position themselves to take advantage of emerging opportunities while managing the risks that come with uncertainty.

Share on

Similar articles

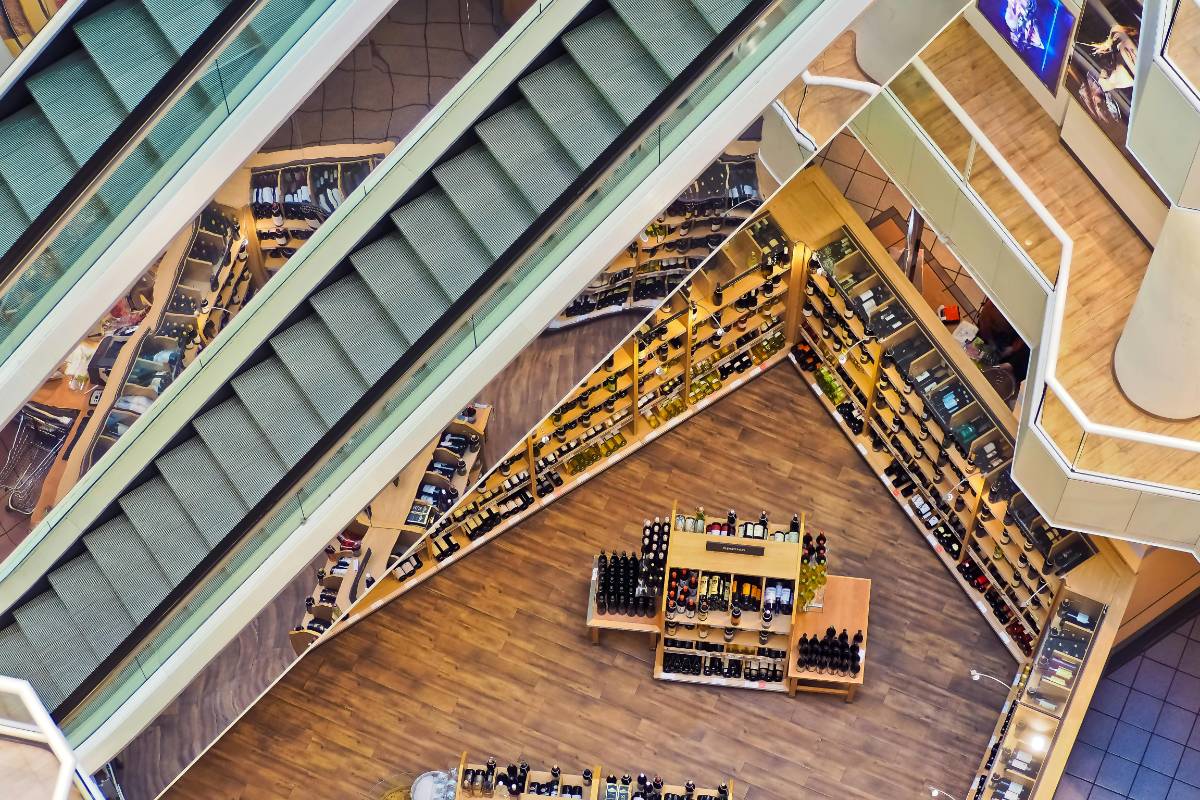

The Future of Supermarket Design: What’s Next?

3 min read | 18 Jan 2025

How Supermarkets Are Responding to the Demand for Plant-Based Products

5 min read | 17 Jan 2025

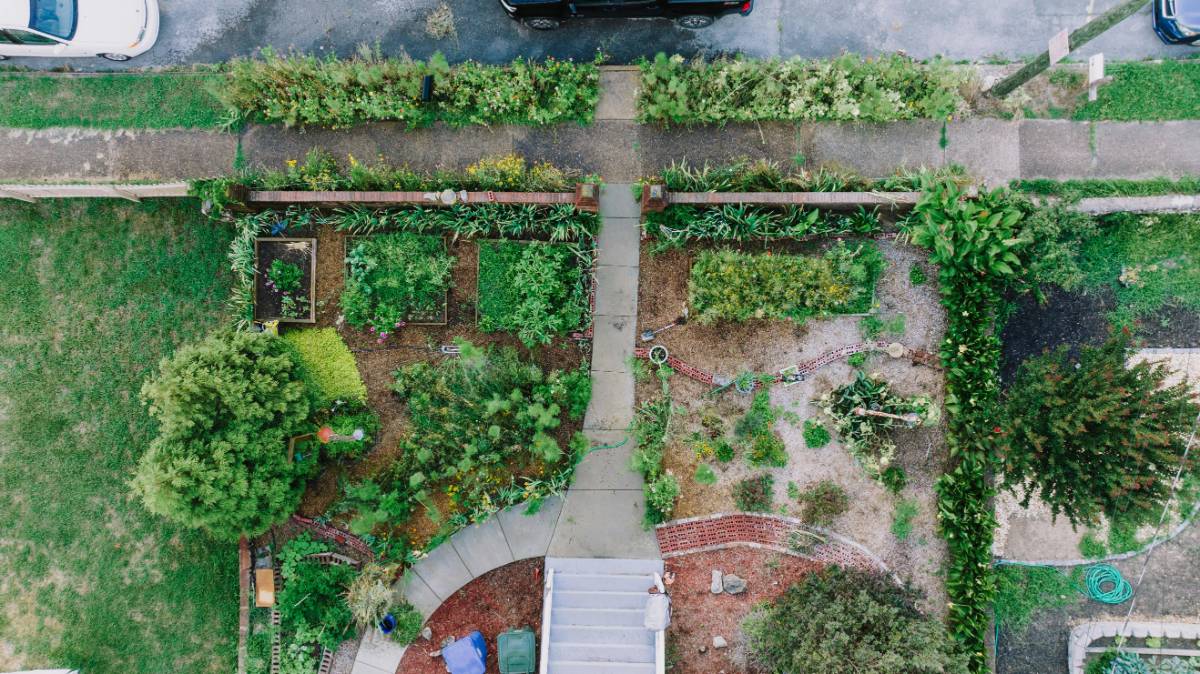

The Role of Supermarkets in Promoting Sustainable Agriculture

4 min read | 16 Jan 2025